Poor Alan Mulally, Ford's new CEO. When it rains, it pours.

I've written here, and here, recently, of Ford's rather interesting, if perilous, changes.

From article in The Wall Street Journal this morning, it appears that Ford is making a combination of the worst choices among its various options on several fronts.

The company is looking to buyout out as much as 30% of its workforce, but is not announcing the termination or sale of any of its auto brands. Further, and one of the reasons for the sudden move to shed employees, is Ford's new forecast that profitability will not be in sight until after 2008, rather than during that year. It turns out, as I wondered last year, in this October post, that Ford is running out of time and money.

Throughout all of this information, I am reminded of Holman Jenkins' stressing how much is already going on at Ford, in an almost unstoppable manner, as Mulally arrives. The plant closings, buyouts, layoffs, and cost-cutting have been either underway or are now culminating in agreements with the UAW.

Then, this week, several senior executive departures were announced. Anne Stevens, a senior North American manager involved in the company's turnaround plans, has left. A few other managers are retiring. To Jenkins' point, were Mulally bringing in his own team, this might be opportune. Instead, he'll be attempting to sail the Titanic short-handed.

When I consider the two articles I cited recently offering free advice to Ford, and the actions announced today, the company's future does, indeed, seem a bit dimmer suddenly. Expensive, cash-consuming labor buyouts on one hand, and the retention of bloated brands, product lines and business units on the other, portray a company still in denial. Perhaps, as Jenkins suggested, a family still in denial.

Based upon today's events, it would seem that Ford, should it survive the next few years, will be a much smaller car company, if it manages to remain independent.

Thursday, September 14, 2006

Apple Announces the Missing Link

Yesterday, Apple announced its iTV device to stream content to the Apple computer-like box, essentially a video-application digital file storage and management device, wired to a TV's video and audio inputs. As expected, and described in the Wall Street Journal, it will use a home wireless network to receive files from a Mac or PC. It even has a wireless controller, as I expected (ok, who wouldn't, at this point, right?).

Finally, the end game is now in sight for network television, and physical film distribution. This device, and its competitors from various other electronics purveyors, will finally allow consumers to shop for video content online, and download it in custom fashion to their home digital storage devices for play/temporary usage/ownership.

I've opined on this development over the past few months in prior posts like this one from February. It spells the final draining of value from the network television model, not to mention Blockbuster, and probably even Netflix. It's even possible this could be the next "killer app" in the consumer digital device world which forces massive upgrading of what one still calls "personal computers."

In any event, by June of 2007, the instrument of broadcast and physical video content distribution will be tangibly at hand, for about $300 (again, more or less my expectation of the price point). So, give things a year or so to shake out, and basic models of competitive units should sell for about $250-300.

As I wrote late last month, here, the less obvious victims of this innocuous little digital box will, I predict, be Verizon, AT&T, and the cable companies. With this final wireless link to what amounts to a digital video server wired to your TV, who needs Comcast's predetermined menu of channels and air times? Just start paying for the content you want, either from a "general store" like iTunes, or Amazon, or, go directly to URLs of the content producers and use your credit card or PayPal.

I am, in any case, quite excited at this new development. Even now, as I finish composing this, I am listening to CNBC's review of the new Microsoft iPod competitor, a type of video/audio file viewing/listening device that wirelessly shares with other users.

The race to market a wide variety of wireless multi-media devices is full on now. The winners and losers will probably include many accidents along the way- unintended casualties, and lucky successes. I'm looking forward to the competition, but I expect that, in the end, this will benefit unbundled, superior producers in every area of the new markets- content, device design, and selective disintermediation of content management.

Finally, the end game is now in sight for network television, and physical film distribution. This device, and its competitors from various other electronics purveyors, will finally allow consumers to shop for video content online, and download it in custom fashion to their home digital storage devices for play/temporary usage/ownership.

I've opined on this development over the past few months in prior posts like this one from February. It spells the final draining of value from the network television model, not to mention Blockbuster, and probably even Netflix. It's even possible this could be the next "killer app" in the consumer digital device world which forces massive upgrading of what one still calls "personal computers."

In any event, by June of 2007, the instrument of broadcast and physical video content distribution will be tangibly at hand, for about $300 (again, more or less my expectation of the price point). So, give things a year or so to shake out, and basic models of competitive units should sell for about $250-300.

As I wrote late last month, here, the less obvious victims of this innocuous little digital box will, I predict, be Verizon, AT&T, and the cable companies. With this final wireless link to what amounts to a digital video server wired to your TV, who needs Comcast's predetermined menu of channels and air times? Just start paying for the content you want, either from a "general store" like iTunes, or Amazon, or, go directly to URLs of the content producers and use your credit card or PayPal.

I am, in any case, quite excited at this new development. Even now, as I finish composing this, I am listening to CNBC's review of the new Microsoft iPod competitor, a type of video/audio file viewing/listening device that wirelessly shares with other users.

The race to market a wide variety of wireless multi-media devices is full on now. The winners and losers will probably include many accidents along the way- unintended casualties, and lucky successes. I'm looking forward to the competition, but I expect that, in the end, this will benefit unbundled, superior producers in every area of the new markets- content, device design, and selective disintermediation of content management.

"Free Advice for Ford"

Tuesday's and Wednesday's editions of the Wall Street Journal featured incredibly good pieces about Ford.

The first piece, written by Charlie Hughes (former CEO of Land Rover) and William Jeanes (former editor in chief of Car and Driver), succinctly pares suggestions for Ford's new CEO, Alan Mulally, down to three.

First, they recommend that Mulally's main objective be to make "the Ford brand the most successful brand in the world." Toyota, they believe, is Mulally's "new Airbus." A simple, compelling objective on which to focus the beleaguered firm.

Next, they advocate combining, divesting and eliminating the company's car brands to leave just the three remaining, and then put the full force of the company's efforts behind those brands. The brands they recommend retaining are Ford, Volvo and Jaguar. There is a sense to this, because those three, together, cover a maximal spectrum of customer segments, while being few enough in number to allow each brand to have similar products, but without any real chance of product/market overlap.

Finally, they suggest that Mulally has to create a new culture at Ford, to have any chance of success. They posit, reasonably, that a combination of years of careerist management, with a recent drumbeat of failure, has left the company bereft of much chance of success in its current condition.

I found their article elegantly reasonable, powerful and simple in its messages. Of course, much quantitative work will be required, whatever direction the new CEO takes, in order to have any hope of turning Ford around. But Hughes and Jeanes articulate a nice combination of suggestions which touch on problems involving customer confusion with overlapping and/or unprofitable brands, the company's own cultural malaise, and an objective which is, they write, "noble."

Yesterday, on the heels of that editorial, came Holman Jenkins' very different approach to offering welcoming advice to Alan Mulally. I like it equally well.

Holman focuses on Mulally's isolation at his new employer. Not only does Mulally have no troops with him from Boeing, obviating his ability to dismiss unwanted existing staff, but the "old king" still reigns. Not an enviable position.

Then Holman goes off on a truly inspired track. To those who doubt the viability of a private equity buyout at Ford, he notes that one was just done in the semiconductor sector of similar size. The difference, he notes, is the Ford family's intransigence at acknowledging reality. So long as the Fords insist on control, nobody else will use fresh money to bail them out. A condition for their rescue is to surrender control. After all, who got Ford into this mess in the first place?

The overall impression one gets from Mr. Jenkins' piece, especially its discussion of Ford's labor woes, and Mulally's background, is that Ford's new CEO may have his biggest impact not on the firm's strategy, or operations, but on the structure of the firm going forward. Perhaps privately owned, perhaps with significantly different labor dynamics.

Taken together, I find both pieces extremely candid and reasonable regarding Ford's, and Mulally's, options in the near term. Neither necessarily thinks Ford will survive, or independently and publicly. But they highlight some very valid concerns for the ailing auto maker's new CEO.

The first piece, written by Charlie Hughes (former CEO of Land Rover) and William Jeanes (former editor in chief of Car and Driver), succinctly pares suggestions for Ford's new CEO, Alan Mulally, down to three.

First, they recommend that Mulally's main objective be to make "the Ford brand the most successful brand in the world." Toyota, they believe, is Mulally's "new Airbus." A simple, compelling objective on which to focus the beleaguered firm.

Next, they advocate combining, divesting and eliminating the company's car brands to leave just the three remaining, and then put the full force of the company's efforts behind those brands. The brands they recommend retaining are Ford, Volvo and Jaguar. There is a sense to this, because those three, together, cover a maximal spectrum of customer segments, while being few enough in number to allow each brand to have similar products, but without any real chance of product/market overlap.

Finally, they suggest that Mulally has to create a new culture at Ford, to have any chance of success. They posit, reasonably, that a combination of years of careerist management, with a recent drumbeat of failure, has left the company bereft of much chance of success in its current condition.

I found their article elegantly reasonable, powerful and simple in its messages. Of course, much quantitative work will be required, whatever direction the new CEO takes, in order to have any hope of turning Ford around. But Hughes and Jeanes articulate a nice combination of suggestions which touch on problems involving customer confusion with overlapping and/or unprofitable brands, the company's own cultural malaise, and an objective which is, they write, "noble."

Yesterday, on the heels of that editorial, came Holman Jenkins' very different approach to offering welcoming advice to Alan Mulally. I like it equally well.

Holman focuses on Mulally's isolation at his new employer. Not only does Mulally have no troops with him from Boeing, obviating his ability to dismiss unwanted existing staff, but the "old king" still reigns. Not an enviable position.

Then Holman goes off on a truly inspired track. To those who doubt the viability of a private equity buyout at Ford, he notes that one was just done in the semiconductor sector of similar size. The difference, he notes, is the Ford family's intransigence at acknowledging reality. So long as the Fords insist on control, nobody else will use fresh money to bail them out. A condition for their rescue is to surrender control. After all, who got Ford into this mess in the first place?

The overall impression one gets from Mr. Jenkins' piece, especially its discussion of Ford's labor woes, and Mulally's background, is that Ford's new CEO may have his biggest impact not on the firm's strategy, or operations, but on the structure of the firm going forward. Perhaps privately owned, perhaps with significantly different labor dynamics.

Taken together, I find both pieces extremely candid and reasonable regarding Ford's, and Mulally's, options in the near term. Neither necessarily thinks Ford will survive, or independently and publicly. But they highlight some very valid concerns for the ailing auto maker's new CEO.

Wednesday, September 13, 2006

The Boomer Generation's New Behavior Patterns with Aging

Autonation's CEO, Mike Jackson, guest hosted part of CNBC's Squawkbox this morning. For a car salesman, as he described himself, he's a very interesting guy.

He talked at some length about the new patterns of aging spending seen in boomers. That is to say, the Americans now aging into their sixties, near retirement, are spending quite differently than did previous generations of Americans upon approaching retirement.

Essentially, he said that research with which he is familiar shows that this near-retirement generation is working at full throttle later into life, and spending like that as well. They are not slowing down.

He enumerated some examples, mostly of activity-oriented and self-indulgent purchases, such as cars, homes, electronics, etc. The point he drove home is that the impact of these very different spending patterns is causing a number of business-related disciplines to reconsider their assumptions about economic activity for the years ahead.

For instance, he noted the effect this different aged-person behavior would have on product development, calling for different feature mixes than were previously supposed for those advancing into their sixties. Additionally, their increased discretionary, luxury- and comfort-oriented spending should probably lead to changes in economists' assumptions regarding the impact of this generation on various aspects of the economy, including sector stimuli, savings rates, etc.

All in all, a rather thought-provoking appearance from Mr. Jackson. One which reminded me, per my marketing background and training, that fresh data is worth so much, in order to avoid incorrectly extrapolating trends that are no longer valid.

He talked at some length about the new patterns of aging spending seen in boomers. That is to say, the Americans now aging into their sixties, near retirement, are spending quite differently than did previous generations of Americans upon approaching retirement.

Essentially, he said that research with which he is familiar shows that this near-retirement generation is working at full throttle later into life, and spending like that as well. They are not slowing down.

He enumerated some examples, mostly of activity-oriented and self-indulgent purchases, such as cars, homes, electronics, etc. The point he drove home is that the impact of these very different spending patterns is causing a number of business-related disciplines to reconsider their assumptions about economic activity for the years ahead.

For instance, he noted the effect this different aged-person behavior would have on product development, calling for different feature mixes than were previously supposed for those advancing into their sixties. Additionally, their increased discretionary, luxury- and comfort-oriented spending should probably lead to changes in economists' assumptions regarding the impact of this generation on various aspects of the economy, including sector stimuli, savings rates, etc.

All in all, a rather thought-provoking appearance from Mr. Jackson. One which reminded me, per my marketing background and training, that fresh data is worth so much, in order to avoid incorrectly extrapolating trends that are no longer valid.

Tuesday, September 12, 2006

Perspective on Banking: Commodity or Not?

My long-time friend and some-time business partner, Bob, recently sent me a three-part series on the banking industry which appeared in the American Banker recently.

Contained in the third installment of the series was this passage,

"....Brand matters to bankers, even though many observers see banking as a commodity business.

"It's not like we are selling steel; there is a real customer interaction that occurs, both in the branch, on the Internet, over the phone," said Sallie Krawcheck, the chief financial officer of Citigroup Inc. "When you interact with the customer as often as a bank does on an issue that is as important as money, I don't think it is a commodity at all. There is real brand equity in the client experience of these financial services companies." "

I must say that I beg to differ. While branding may matter to bankers, it has historically rarely mattered to customers. Money may be important, but, then, so is oil or copper.

They are commodities, despite their occasional high prices and short supply. Money is no different.

Despite what Krawcheck would like to believe, money is a commodity, and so is credit. If it weren't, we wouldn't have interest rate competition among lenders during periods of healthy growth and credit demand. In fact, her company, Citigroup, is a prime example of how credit and financial services businesses are not well-branded.

Despite what Krawcheck would like to believe, money is a commodity, and so is credit. If it weren't, we wouldn't have interest rate competition among lenders during periods of healthy growth and credit demand. In fact, her company, Citigroup, is a prime example of how credit and financial services businesses are not well-branded.

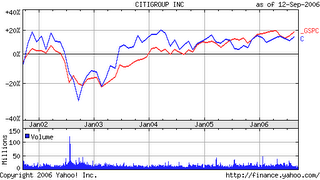

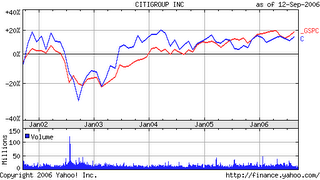

Consider the chart on the left, from Yahoo, displaying Citigroup's stock price relative to the S&P500, for the past five years.

Doesn't look much like a branded goods purveyor with healthy growth and good margins, does it? Unless, of course, it only meets market expectations. However, I'd suggest that whatever Citi has been doing, isn't working.

And that probably includes Krawcheck's insistence that the company's basic product, money and forms thereof, is not a commodity. The whole point of money, credit, and tradeable financial products is to be commodities.

Most consumers resent having to pay and ask a bank for access to their own money. Credit is the one product they go begging for. But even there, in this era of oversupply of credit sources, consumers are more judicious, and less desperate, than they had to be in decades past.

No, I don't think financial services has done very well trying to make credit and money a branded, provider-unique product or service.

Contained in the third installment of the series was this passage,

"....Brand matters to bankers, even though many observers see banking as a commodity business.

"It's not like we are selling steel; there is a real customer interaction that occurs, both in the branch, on the Internet, over the phone," said Sallie Krawcheck, the chief financial officer of Citigroup Inc. "When you interact with the customer as often as a bank does on an issue that is as important as money, I don't think it is a commodity at all. There is real brand equity in the client experience of these financial services companies." "

I must say that I beg to differ. While branding may matter to bankers, it has historically rarely mattered to customers. Money may be important, but, then, so is oil or copper.

They are commodities, despite their occasional high prices and short supply. Money is no different.

Despite what Krawcheck would like to believe, money is a commodity, and so is credit. If it weren't, we wouldn't have interest rate competition among lenders during periods of healthy growth and credit demand. In fact, her company, Citigroup, is a prime example of how credit and financial services businesses are not well-branded.

Despite what Krawcheck would like to believe, money is a commodity, and so is credit. If it weren't, we wouldn't have interest rate competition among lenders during periods of healthy growth and credit demand. In fact, her company, Citigroup, is a prime example of how credit and financial services businesses are not well-branded.Consider the chart on the left, from Yahoo, displaying Citigroup's stock price relative to the S&P500, for the past five years.

Doesn't look much like a branded goods purveyor with healthy growth and good margins, does it? Unless, of course, it only meets market expectations. However, I'd suggest that whatever Citi has been doing, isn't working.

And that probably includes Krawcheck's insistence that the company's basic product, money and forms thereof, is not a commodity. The whole point of money, credit, and tradeable financial products is to be commodities.

Most consumers resent having to pay and ask a bank for access to their own money. Credit is the one product they go begging for. But even there, in this era of oversupply of credit sources, consumers are more judicious, and less desperate, than they had to be in decades past.

No, I don't think financial services has done very well trying to make credit and money a branded, provider-unique product or service.

Monday, September 11, 2006

Intel's Restructuring

Intel's long-awaited restructuring was announced last week. Wednesday's Wall Street Journal featured an article detailing the company's plans. The market has been in suspense since this spring, when Intel's CEO, Paul Otellini, admitted the company was thoroughly reviewing all of its operations. I wrote about that in a post here.

My initial observations are largely sustained by the Intel restructuring plan details. They are cutting 10% of their workforce, mostly middle management. The company's senior management actually admits that they have become bloated and slower at decision-making in the middle ranks. This fits with my overall suspicion that Intel has become a victim of "sand in the gears," the term I use for what happens to a company experiencing successful growth for too long. Mediocre employees and bloated processes combine to begin to gradually silt up the company's ability to recognize and quickly react to changing environmental and/or competitive circumstances.

In this case, the combination of AMD's technological challenge to Intel, and the lowering of desktop and laptop PC systems which constitute so much of the end-user demand for the company's signature microprocessors.

Otellini is quoted as saying, "These actions, while difficult, are essential to Intel becoming a more agile and efficient company, not just for this year or the next, but for years to come." Probably true, but, unfortunately, as my old boss and mentor, Gerry Weiss, SVP of Chase Manhattan Bank's Planning and Corporate Development function would, and did say, 'When a company has to "restructure," that generally means it has failed to adapt to changing conditions in a timely manner. It is an indicator of management failure.'

The company is disposing of various smaller new business units connected with communications equipment, as well as focusing on trimming marketing personnel. This is puzzling to me, as I would have thought that product design was the problem, not marketing.

Typically, cutting resources at a company does not foster growth. While Otellini's restructuring program may, in fact, produce near-term profits, it is not at all clear that the results of the program will re-ignite Intel's ability to create superior value-added for its customers at profitable prices. And, thus, consistently superior total returns for its shareholders over the longer term.

My initial observations are largely sustained by the Intel restructuring plan details. They are cutting 10% of their workforce, mostly middle management. The company's senior management actually admits that they have become bloated and slower at decision-making in the middle ranks. This fits with my overall suspicion that Intel has become a victim of "sand in the gears," the term I use for what happens to a company experiencing successful growth for too long. Mediocre employees and bloated processes combine to begin to gradually silt up the company's ability to recognize and quickly react to changing environmental and/or competitive circumstances.

In this case, the combination of AMD's technological challenge to Intel, and the lowering of desktop and laptop PC systems which constitute so much of the end-user demand for the company's signature microprocessors.

Otellini is quoted as saying, "These actions, while difficult, are essential to Intel becoming a more agile and efficient company, not just for this year or the next, but for years to come." Probably true, but, unfortunately, as my old boss and mentor, Gerry Weiss, SVP of Chase Manhattan Bank's Planning and Corporate Development function would, and did say, 'When a company has to "restructure," that generally means it has failed to adapt to changing conditions in a timely manner. It is an indicator of management failure.'

The company is disposing of various smaller new business units connected with communications equipment, as well as focusing on trimming marketing personnel. This is puzzling to me, as I would have thought that product design was the problem, not marketing.

Typically, cutting resources at a company does not foster growth. While Otellini's restructuring program may, in fact, produce near-term profits, it is not at all clear that the results of the program will re-ignite Intel's ability to create superior value-added for its customers at profitable prices. And, thus, consistently superior total returns for its shareholders over the longer term.

Subscribe to:

Comments (Atom)