My friend B is a truly prescient guy. He's had an enviable career in various parts of the financial service industry, the details of which I will spare the reader, in deference to B's wish for continued anonymity. He still does some consulting, and values his public persona, vis a vis his rather more unvarnished candor with me.

My friend B is a truly prescient guy. He's had an enviable career in various parts of the financial service industry, the details of which I will spare the reader, in deference to B's wish for continued anonymity. He still does some consulting, and values his public persona, vis a vis his rather more unvarnished candor with me.I can vividly recall my phone call with him in early 1996, when I was the first Director of Research for Oliver, Wyman & Co., now the financial services consulting unit of Mercer Management Consulting. As I was sitting in the firm's computer room, watching over the crunching of some data on my large-scale study of what accounted for superior returns in financial services companies, B and I were discussing trends in the industry. He predicted that, henceforth, the money center banks of the day would conglomerate further into only 3-4 financial "utilities." By that he meant money center banks plus ancillary businesses- brokerage, asset management, and insurance. Or variants thereof.

Well, we're there now. With Citigroup as the vanguard of the then-illegal union of banking and securities businesses, there are now three roughly interchangeable giant financial utilities in the US: Citi, BofA, and Chase. BofA acquired MBNA, and Chase's merger with Banc One combined a huge chunk of midwestern bank assets with the second-largest New York City banking company.

In a recent exchange of phone calls and emails, B commented that in the most recent quarter, all three companies had similar results, proportionally, with likewise similar strong and weak unit performances. He wondered aloud whether we are now at a point where these financial utilities are essentially on autopilot, and need not really be "led" by anyone. In short, the CEOs have become largely irrelevant and interchangeable.

I think B is right. The current CEOs of Chase and Citi are very, very pale shadows of David Rockefeller and Walter Wriston, titans who led much more dynamic and unique institutions in their days. I don't even know offhand who runs BofA, but I see from its Yahoo profile page that it is indeed Ken Lewis, the surviving CEO of what was once, long ago, NCNB. Or First Union. I can't recall which of them eventually got BofA, and which is now "Wachovia."

Even the second-tier utilities are pretty similar as well. Conglomerations of what we used to call "regional" banks. Wells Fargo and Wachovia are all that remain of First Interstate, Security Pacific, First Bank System, Wachovia, and one of the two Charlotte-based banks that isn't now BofA.

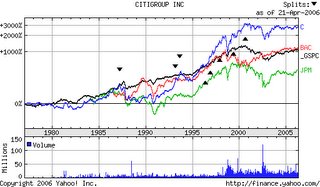

To continue, B suggested I go check the market performance of the three major financial utilities to see if those performances, too, have become very similar. I did, and I think one would say, "yes," they are not so very different now.

The top of this post features a Yahoo-generated price chart for some 30 years, as a sort of long-term secular trend reference. While it is not, technically, a total return chart, the change in stock prices, assuming reasonably similar dividend policies, is close.

What I note from the very long term is that, distortions of compounding on very recent years aside, the performances of Chase and Citi have been nearly identical since 1995. Since roughly 1992, all three seem to perform similarly.

Very recently, Chase seems to have gained a bit more acceleration. But with the recent spate of acquisitions, it's not clear what the longer-term, steady-state performances will be.

Overall, though, I think my colleague B's observations and insights are correct. It really doesn't much matter who is at the helm of these utilities anymore. With a few exceptions, such as Citi's recent swap of asset management for a brokerage business, they are now subject to the same global and US forces, have similar business and asset bases, face similar raw material (i.e., money) and operating costs. And thus, I would be surprised if any of the three financial utilities, Citi, Chase and BofA, achieve consistently superior total returns in the future that none of them have attained in the past. It's not something one usually sees in diversified financial service firms alone, let alone 'this' diversified and gargantuan.

No comments:

Post a Comment