Back in May, I noted that Intel's CEO, Paul Otellini, was conducting a major review of Intel's troubled operations. In this post, and this one, I opined that perhaps Intel is the victim of its considerable success of the past 20 years. And that its current sales and marketing troubles are quite possibly a natural result of too much growth, diversification, and loss of detailed customer focus over the years.

Now comes a piece in the Wall Street Journal announcing Otellini's fixes for the firm. Apparently, two and a half months of soul-searching and deep analysis at Intel has resulted in a senior management reorganization of roles. Two retirements, no firings, and, otherwise, just a shuffling of spans of control, reporting lines, and such. The stated goal of all this shuffling is improved efficiency.

Given that Intel's problems seem to stem from not listening to customers, I'm a little puzzled to read that their solution is to rearrange current senior managment, but not directly address competitive marketing and product development. If anything, the apparent assignment of development and pricing activities to single senior executives would seem to make those functions even more abstracted from individual customers and business units.

Maybe I'm wrong. Time will tell. But thus far, it's fairly disappointing to see Intel limit its rehabilitation to essentially rearranging deck chairs, while AMD continues to surge forward with sales and market share growth.

Saturday, July 22, 2006

Friday, July 21, 2006

Searching for Patterns in Financial Information: Part 1

Lately, my business partner has been reading about the similarities between the development of entropy theory in physics, and Claude Shannon's development of information theory. The parallels are striking, down to the similar forms of the equations for calculating the amount of entropy in a container of gas, or the amount of information in a set of symbols.

As we discussed this, we realized that, in an abstract form, "efficient market" theory is a crude way of approximating the same result. That is, a very efficient market would have little differentiation in prices for a security, much as an end state of a gas in a container is total dispersion to a (largely) uniform density.

However, of some interest to him, and me, was the development of probability distributions to account for the non-uniform density of dispersed gases. In a similar way, one might observe distributions of prices for a given security within a short period of time.

We realized that, according to efficient market theory, absent new information, the investors in a market are assumed to act in such a way as to arrive at a state of price entropy. Just as there is no more movement once a gas is perfectly dispersed, so prices are expected not to move, absent new information.

So far, an interesting comparison. But perhaps seen as just that, and of no particular value to understanding equity markets, or selecting equity portfolios.

As we discussed this further, he dwelt more on Shannon's information theory. Shannon focused on how to identify a signal amidst the noise of a stream of "information." This, my partner conjectured, is virtually identical to the task of a portfolio manager. The manager must attempt to identify relevant information, which is related to particular price changes, and ignore the noise in the distribution of information in the market.

At this point, I interjected that market information not random in the same way as naturally occurring phenomena may be. There are actors on each side of securities prices. Securities prices are not just streams of random numbers attached to a meaningless ticker.

Rather, there are real companies, composed of real people, behind each ticker. They are engaged in teleological behavior- hopefully, the production of profits, in order to increase total returns for their shareholders.

On the other side, there are real investors attempting to discern patterns from the torrent of market and fundamental information about the companies. These investors buy and sell securities, based upon their interpretations of this information, thus providing some goal-oriented impetus to prices.

I believe that because securities prices are, ultimately, the product of these goal-oriented activities, the process of identifying patterns in fundamental and technical market data, in order to find equities which have a high probability of earning consistently superior total returns, is actually easier than dealing with truly random data.

However, due to the differing abilities of the actors on both sides- company employees and managers, and investors- finding the patterns is not simple.

But, like distributions of energy levels in particles, or distributions of information content among symbols in a series, there are distributions of information with respect to equities selection among the fundamental and technical information available for observation. As a distribution, this means that there will be occasions in which information content is high. Meaning that not all the value in knowing it has been removed via discovery.

When this happens, portfolios of such equities can outperform the market averages, contradicting efficient market theory. Thus, in effect, we find that efficient market theory posits simple point-estimates of prices, whereas viewing the problem in the same manner as entropy or information theory allows for "tails" of value-laden information which can cause equities to be mis-priced, and allow for consistently superior returns to be earned.

As we discussed this, we realized that, in an abstract form, "efficient market" theory is a crude way of approximating the same result. That is, a very efficient market would have little differentiation in prices for a security, much as an end state of a gas in a container is total dispersion to a (largely) uniform density.

However, of some interest to him, and me, was the development of probability distributions to account for the non-uniform density of dispersed gases. In a similar way, one might observe distributions of prices for a given security within a short period of time.

We realized that, according to efficient market theory, absent new information, the investors in a market are assumed to act in such a way as to arrive at a state of price entropy. Just as there is no more movement once a gas is perfectly dispersed, so prices are expected not to move, absent new information.

So far, an interesting comparison. But perhaps seen as just that, and of no particular value to understanding equity markets, or selecting equity portfolios.

As we discussed this further, he dwelt more on Shannon's information theory. Shannon focused on how to identify a signal amidst the noise of a stream of "information." This, my partner conjectured, is virtually identical to the task of a portfolio manager. The manager must attempt to identify relevant information, which is related to particular price changes, and ignore the noise in the distribution of information in the market.

At this point, I interjected that market information not random in the same way as naturally occurring phenomena may be. There are actors on each side of securities prices. Securities prices are not just streams of random numbers attached to a meaningless ticker.

Rather, there are real companies, composed of real people, behind each ticker. They are engaged in teleological behavior- hopefully, the production of profits, in order to increase total returns for their shareholders.

On the other side, there are real investors attempting to discern patterns from the torrent of market and fundamental information about the companies. These investors buy and sell securities, based upon their interpretations of this information, thus providing some goal-oriented impetus to prices.

I believe that because securities prices are, ultimately, the product of these goal-oriented activities, the process of identifying patterns in fundamental and technical market data, in order to find equities which have a high probability of earning consistently superior total returns, is actually easier than dealing with truly random data.

However, due to the differing abilities of the actors on both sides- company employees and managers, and investors- finding the patterns is not simple.

But, like distributions of energy levels in particles, or distributions of information content among symbols in a series, there are distributions of information with respect to equities selection among the fundamental and technical information available for observation. As a distribution, this means that there will be occasions in which information content is high. Meaning that not all the value in knowing it has been removed via discovery.

When this happens, portfolios of such equities can outperform the market averages, contradicting efficient market theory. Thus, in effect, we find that efficient market theory posits simple point-estimates of prices, whereas viewing the problem in the same manner as entropy or information theory allows for "tails" of value-laden information which can cause equities to be mis-priced, and allow for consistently superior returns to be earned.

Thursday, July 20, 2006

Revenue Growth Targets in Large Cap Firms

A recent article by Carol Hymowitz in her Wall Street Journal column, "In The Lead," which focuses on CEOs, featured Robert Lane of John Deere, the farm equipment maker.

The piece discussed Deere's commitment to R&D and innovation, though it cited no specific revenue growth target. By way of demonstrating that revenue growth is now a top priority among CEOs, Hymowitz quoted Jeff Immelt, CEO of GE, as setting an 8% annual revenue growth rate.

From my proprietary research, I can confirm that GE's sales growth target is too low to ever place it among the consistently high-growth, superior total return companies of the S&P500.

That is not to say that revenue growth below double-digits is useless. For those companies mired....er...positioned in largely slower-growth sectors, new products and services are necessary to offset the Schumpeterian effects of eroding value-added of older offerings. Rather like Lewis Carroll's "Through the Looking Glass, the Red Queen has characters run, and explains,

"HERE, you see, it takes all the running YOU can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!"

Just so. Without attention to innovation to drive revenue growth, even slower-growth companies will slowly experience flattening, then shrinking sales. Sort of like...GM.

It's great to see that even relatively staid companies such as farm equipment manufacturer John Deere is attending to innovation and growth. And it is also reassuring to see its CEO attending to revenue growth through innovation. However, targeting only 8-9% annual growth rates won't result in its escaping the gravitational-like pull of the large number of middling large-cap firms that experience inconsistent, or just slightly-above-average revenue growth.

And, thus, it's unlikely that Deere, or GE, will soon, if ever, be selected for our equity portfolios. It's hard work, but not exceptional, for a firm to generate consistent single-digit sales growth for years. Thus, the likelihood that such a firm will consistently outperform the S&P on total return is not as great as it is for consistently higher-growth firms.

The piece discussed Deere's commitment to R&D and innovation, though it cited no specific revenue growth target. By way of demonstrating that revenue growth is now a top priority among CEOs, Hymowitz quoted Jeff Immelt, CEO of GE, as setting an 8% annual revenue growth rate.

From my proprietary research, I can confirm that GE's sales growth target is too low to ever place it among the consistently high-growth, superior total return companies of the S&P500.

That is not to say that revenue growth below double-digits is useless. For those companies mired....er...positioned in largely slower-growth sectors, new products and services are necessary to offset the Schumpeterian effects of eroding value-added of older offerings. Rather like Lewis Carroll's "Through the Looking Glass, the Red Queen has characters run, and explains,

"HERE, you see, it takes all the running YOU can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!"

Just so. Without attention to innovation to drive revenue growth, even slower-growth companies will slowly experience flattening, then shrinking sales. Sort of like...GM.

It's great to see that even relatively staid companies such as farm equipment manufacturer John Deere is attending to innovation and growth. And it is also reassuring to see its CEO attending to revenue growth through innovation. However, targeting only 8-9% annual growth rates won't result in its escaping the gravitational-like pull of the large number of middling large-cap firms that experience inconsistent, or just slightly-above-average revenue growth.

And, thus, it's unlikely that Deere, or GE, will soon, if ever, be selected for our equity portfolios. It's hard work, but not exceptional, for a firm to generate consistent single-digit sales growth for years. Thus, the likelihood that such a firm will consistently outperform the S&P on total return is not as great as it is for consistently higher-growth firms.

Heavy Oil Reserves: Economics Still Works

There was a terrific article in the Wall Street Journal the other day describing Chevron's work on the recovery of heavy oil in Saudi Arabia.

What I found reassuring about the piece is that it reinforces my faith in human behavior and economics, which studies that behavior in the area of value exchange.

Basically, as light-oil reserves are drawn down, and crude oil prices rise, the incentive to recover deposits of heavy oil has risen. Chevron is working to recover the substantial Saudi reserves of this molasses-like material. According to the piece, including heavy oil reserves to the Saudi offical reserves would add "tens of billions of barrels" to their current 260 billion barrel estimate.

Buried in the article was a passing reference to the "peak oil" theory. According to the WSJ piece, adding recoverable heavy-oil reserves to the world's oil supply would put a major dent in the theory that we are on the brink of pumping ever-declining amounts of crude each year. This would appear to be no small thing. With India and China bidding up the price of existing supplies of crude in the past year, the prospect of declining crude supply would be a potentially civilization-altering phenomenon.

It's nice to see economic theory still describes how humans react to shortages. As crude prices have more than tripled since 2002, alternatives such as gassified coal, liquified natural gas, tar sands, and, now, heavy-oil are coming onstream to compete with the higher-priced light crude supplies.

Even at $3/gallon, gasoline is cheaper on a real basis now, in the US, than it was at the height of the Arab oil embargo of the mid-1970s. It remains to be seen if these admittedly-higher gasoline, and related, energy prices cause a global recession, but it is by no means at all certain. Recent estimates by economists put the chances at perhaps as high as 36%, up from 17% six months ago. When I read that, I thought it made sense. With higher energy prices and mideast violence, there is a natural concern that energy security issues will contribute to higher prices, and, thus, economic slowdown.

However, as recently as yesterday, Fed Chairman Bernanke reiterated Greenspan's comments of last year, that the US economy has displayed amazing resilience in the face of higher energy costs.

With the price signals of higher energy costs, new supplies are predictably coming onstream. Julian Simons would be so pleased to see his beliefs once again sustained. When these various alternative energy sources provide supply to the market, we should expect to have a near-term ceiling on energy prices and more supply for some time to come.

Crisis identified. Crisis resolved. Free-market style.

Like other resource supply issues of the past, such as silk (nylon, et al), rubber (synthetic rubber in WWII), and steel (minimills), energy, too, will fall to human ingenuity and the desire of people to make a buck solving economic problems.

What I found reassuring about the piece is that it reinforces my faith in human behavior and economics, which studies that behavior in the area of value exchange.

Basically, as light-oil reserves are drawn down, and crude oil prices rise, the incentive to recover deposits of heavy oil has risen. Chevron is working to recover the substantial Saudi reserves of this molasses-like material. According to the piece, including heavy oil reserves to the Saudi offical reserves would add "tens of billions of barrels" to their current 260 billion barrel estimate.

Buried in the article was a passing reference to the "peak oil" theory. According to the WSJ piece, adding recoverable heavy-oil reserves to the world's oil supply would put a major dent in the theory that we are on the brink of pumping ever-declining amounts of crude each year. This would appear to be no small thing. With India and China bidding up the price of existing supplies of crude in the past year, the prospect of declining crude supply would be a potentially civilization-altering phenomenon.

It's nice to see economic theory still describes how humans react to shortages. As crude prices have more than tripled since 2002, alternatives such as gassified coal, liquified natural gas, tar sands, and, now, heavy-oil are coming onstream to compete with the higher-priced light crude supplies.

Even at $3/gallon, gasoline is cheaper on a real basis now, in the US, than it was at the height of the Arab oil embargo of the mid-1970s. It remains to be seen if these admittedly-higher gasoline, and related, energy prices cause a global recession, but it is by no means at all certain. Recent estimates by economists put the chances at perhaps as high as 36%, up from 17% six months ago. When I read that, I thought it made sense. With higher energy prices and mideast violence, there is a natural concern that energy security issues will contribute to higher prices, and, thus, economic slowdown.

However, as recently as yesterday, Fed Chairman Bernanke reiterated Greenspan's comments of last year, that the US economy has displayed amazing resilience in the face of higher energy costs.

With the price signals of higher energy costs, new supplies are predictably coming onstream. Julian Simons would be so pleased to see his beliefs once again sustained. When these various alternative energy sources provide supply to the market, we should expect to have a near-term ceiling on energy prices and more supply for some time to come.

Crisis identified. Crisis resolved. Free-market style.

Like other resource supply issues of the past, such as silk (nylon, et al), rubber (synthetic rubber in WWII), and steel (minimills), energy, too, will fall to human ingenuity and the desire of people to make a buck solving economic problems.

Tuesday, July 18, 2006

Home Depot Revisited: Before Nardelli

Yesterday, I compared the recent performances of Lowes and Home Depot, in an attempt to understand the accolades given Bob Nardelli for allegedly "turning around" the fundamentals at the latter company since his arrival in late 2000.

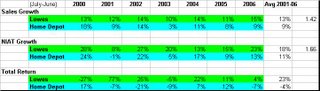

Yesterday, I compared the recent performances of Lowes and Home Depot, in an attempt to understand the accolades given Bob Nardelli for allegedly "turning around" the fundamentals at the latter company since his arrival in late 2000.In that piece, I found, using the data in the table above, from Compustat, that Nardelli does not seem to have outperformed his main competitor over the last 5 years. Home Depot's sales growth rate is not so impressive and is inconsistent as well. From my proprietary research, I would conclude that these operating characteristics alone account for Home Depot's dismal total returns since Nardelli's taking the CEO position. NIAT performance isn't much better, confirming the low regard in which investors seem to hold the company now.

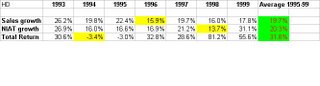

It wasn't always thus. Back in July, 1999, I held Home Depot in my equity portfolio. It's performance was so strong and consistent, among that of the S&P500 field, that it was selected for inclusion, among other consistently superior companies. It subsequently returned roughly 60% from July to December, 1999.

As the table at the left shows, the Home Depot of that era was a much differently performing company. Note the much higher growth rates for sales and NIAT. The green backgrounded column provides the simple averages for sales and NIAT growth, and total returns, for mid-1993 to mid-1999. The yellow highlighted cells indicate the minimum value for the measure during the period shown. Clicking on the table will bring up an enlarged view.

As the table at the left shows, the Home Depot of that era was a much differently performing company. Note the much higher growth rates for sales and NIAT. The green backgrounded column provides the simple averages for sales and NIAT growth, and total returns, for mid-1993 to mid-1999. The yellow highlighted cells indicate the minimum value for the measure during the period shown. Clicking on the table will bring up an enlarged view.Comparing these values to the ones describing Home Depot recently, one can see why the firm was much more highly valued seven years ago. It was a consistently superior, growing large-cap firm.

It's total returns were correspondingly above-average. This type of performance of a large-cap company should earn the CEO extraordinary compensation. By contrast, Nardelli's 5 year record justifies nothing even close to a compensation package suggesting he has brought success to Home Depot.

Whether Home Depot's performance was bound to decline, due to time and probabilities, is arguable. But, if it were, even more reason not to overcompensate the next CEO for failing to offset those odds. However, what is curious to me is that Home Depot hasn't underperformed on total return because investors learned to expect excellent fundamental performance from the firm. Rather, its fundamental performance simply fell apart. And that has nothing to do with "uncontrollable market forces." Those are the types of problems CEOs are well-paid to fix. And Nardelli has not done that during his five years leading Home Depot.

Monday, July 17, 2006

Lowes vs. Home Depot: Nardelli's Performance

There has been considerable discussion of Bob Nardelli's performance and personal behavior during his stint as CEO of Home Depot. Nardelli arrived at HD in late 2000, fresh from GE, where he was also known as, I learned recently, "little Jack." I'm not sure one can say it was affectionately, unless perhaps by Welch.

While discussing the Nardelli/Home Depot flap with my partner yesterday morning, I contended that the reason for Home Depot's lackluster total returns under Nardelli are probably accounted for by the pattern of sales growth during his reign. My partner asked me to compare Lowes and Home Depot to see if my contention is correct. During the recent flare up of criticism over Nardelli's handling of Home Depot's annual meeting, several people commented that Nardelli has turned the company around, in terms of fundamental operating performance. He is apparently pitied for doing the right operating things, but getting "no credit" from the market, in the form of total returns for his shareholders. I wanted to see if this is, in fact, true, as did my partner.

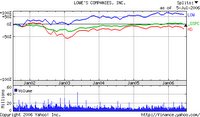

In order to evaluate these comments, I first looked at a Yahoo chart of Lowes and Home Depot's stock prices over the past 5 years. As I mentioned in a prior post, Lowes has clearly outperformed over this recent period.

In order to evaluate these comments, I first looked at a Yahoo chart of Lowes and Home Depot's stock prices over the past 5 years. As I mentioned in a prior post, Lowes has clearly outperformed over this recent period.

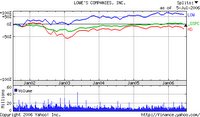

This is in stark contrast to the longer term performance of the two companies' stock prices. The Yahoo price chart at the left, going back to 1985, shows a much different picture.

This is in stark contrast to the longer term performance of the two companies' stock prices. The Yahoo price chart at the left, going back to 1985, shows a much different picture.

Here, we see that Home Depot was on a tear, until ....oops...2000. Just before Nardelli took over, the company hit a flat spot, from which it has yet to recover. In fact, it's stock price has actually declined since Nardelli took the helm.

Lowes, on the other hand, has had a rather constant, although slower, stock price rise over the last 21 years. It was a little flat in the late '80s, then began a reasonably monotonic rise in stock price that continued until very recently.

Over the entire period, Home Depot was the better investment, and both Lowes and Home Depot outperformed the S&P500 Index. But, these views don't include dividends, in case they make a significant difference, nor fundamental data, such as sales or profit growth.

For that view, I went to my Compustat data and retrieved the total returns, sales and NIAT data for Lowes and Home Depot from July, 1999, to June, 2006. The table at the left displays the performances for the two companies on these fundamental and technical dimensions. You may click on it to see the enlarged view.

For that view, I went to my Compustat data and retrieved the total returns, sales and NIAT data for Lowes and Home Depot from July, 1999, to June, 2006. The table at the left displays the performances for the two companies on these fundamental and technical dimensions. You may click on it to see the enlarged view.

The top two rows display the annual nominal sales growth of the two companies since 2000. Leaving out 2000, in order to only measure the Nardelli years, we see that Lowes has an average annual sales growth of 13% during the period. This is 1.42x that of Home Depot's average annual sales growth of 9%. That seems to be to be a good reason why Lowes has done better for its shareholders lately. But look at the worst sales growth years for each firm. Lowes never dropped below 10%, while Home Depot had two years in which its sales growth was 3% and an 8%. And these were after 2002, well into the Nardelli era.

If Bob Nardelli has turned Home Depot around, we haven't seen it in the sales growth numbers.

Looking at NIAT (net income after tax), we see a similar pattern. Lowes' average annual NIAT growth is 1.66x that of Home Depot, or 18% vs. 11%. Again, Lowes' worst year featured an 8% growth rate, while Home Depot's was -1%. A decline. Not good for investor confidence.

Here, again, we see no evidence of the 'Nardelli operating turnaround' at Home Depot. I have to confess, I just don't see what Welch, Maria Bartiromo, and others are squawking about. Nardelli's company has lousy stock price performance because its operating performance is uneven and below that of its major competitor.

But, just to be thorough, let's take a look at the actual annual total returns since 2001. That is the third set of paired rows of data in the table. Home Depot's simple average annual return for the period is -4%. Lowes earned an average annual total return of 23% for the same period. Neither company has had a very consistent total return. Which would be at least one reason why neither would be among my equity portfolio selections for the past few years.

However, it seems pretty clear to me that, since 2001, Lowes has exhibited higher and more consistent sales and income growth than has Home Depot. The data doesn't seem to support a "turnaround" by Nardelli, unless his company was doing even worse before he got there. But the stock price data suggest that isn't true.

When you look at the data, Nardelli hasn't performed well for his shareholders on fundamental operating measures like sales and income growth. Is it really surprising the stock price is down, and the company's total returns have trailed both its major competitor, Lowes, and the S&P?

While discussing the Nardelli/Home Depot flap with my partner yesterday morning, I contended that the reason for Home Depot's lackluster total returns under Nardelli are probably accounted for by the pattern of sales growth during his reign. My partner asked me to compare Lowes and Home Depot to see if my contention is correct. During the recent flare up of criticism over Nardelli's handling of Home Depot's annual meeting, several people commented that Nardelli has turned the company around, in terms of fundamental operating performance. He is apparently pitied for doing the right operating things, but getting "no credit" from the market, in the form of total returns for his shareholders. I wanted to see if this is, in fact, true, as did my partner.

In order to evaluate these comments, I first looked at a Yahoo chart of Lowes and Home Depot's stock prices over the past 5 years. As I mentioned in a prior post, Lowes has clearly outperformed over this recent period.

In order to evaluate these comments, I first looked at a Yahoo chart of Lowes and Home Depot's stock prices over the past 5 years. As I mentioned in a prior post, Lowes has clearly outperformed over this recent period. This is in stark contrast to the longer term performance of the two companies' stock prices. The Yahoo price chart at the left, going back to 1985, shows a much different picture.

This is in stark contrast to the longer term performance of the two companies' stock prices. The Yahoo price chart at the left, going back to 1985, shows a much different picture.Here, we see that Home Depot was on a tear, until ....oops...2000. Just before Nardelli took over, the company hit a flat spot, from which it has yet to recover. In fact, it's stock price has actually declined since Nardelli took the helm.

Lowes, on the other hand, has had a rather constant, although slower, stock price rise over the last 21 years. It was a little flat in the late '80s, then began a reasonably monotonic rise in stock price that continued until very recently.

Over the entire period, Home Depot was the better investment, and both Lowes and Home Depot outperformed the S&P500 Index. But, these views don't include dividends, in case they make a significant difference, nor fundamental data, such as sales or profit growth.

For that view, I went to my Compustat data and retrieved the total returns, sales and NIAT data for Lowes and Home Depot from July, 1999, to June, 2006. The table at the left displays the performances for the two companies on these fundamental and technical dimensions. You may click on it to see the enlarged view.

For that view, I went to my Compustat data and retrieved the total returns, sales and NIAT data for Lowes and Home Depot from July, 1999, to June, 2006. The table at the left displays the performances for the two companies on these fundamental and technical dimensions. You may click on it to see the enlarged view.The top two rows display the annual nominal sales growth of the two companies since 2000. Leaving out 2000, in order to only measure the Nardelli years, we see that Lowes has an average annual sales growth of 13% during the period. This is 1.42x that of Home Depot's average annual sales growth of 9%. That seems to be to be a good reason why Lowes has done better for its shareholders lately. But look at the worst sales growth years for each firm. Lowes never dropped below 10%, while Home Depot had two years in which its sales growth was 3% and an 8%. And these were after 2002, well into the Nardelli era.

If Bob Nardelli has turned Home Depot around, we haven't seen it in the sales growth numbers.

Looking at NIAT (net income after tax), we see a similar pattern. Lowes' average annual NIAT growth is 1.66x that of Home Depot, or 18% vs. 11%. Again, Lowes' worst year featured an 8% growth rate, while Home Depot's was -1%. A decline. Not good for investor confidence.

Here, again, we see no evidence of the 'Nardelli operating turnaround' at Home Depot. I have to confess, I just don't see what Welch, Maria Bartiromo, and others are squawking about. Nardelli's company has lousy stock price performance because its operating performance is uneven and below that of its major competitor.

But, just to be thorough, let's take a look at the actual annual total returns since 2001. That is the third set of paired rows of data in the table. Home Depot's simple average annual return for the period is -4%. Lowes earned an average annual total return of 23% for the same period. Neither company has had a very consistent total return. Which would be at least one reason why neither would be among my equity portfolio selections for the past few years.

However, it seems pretty clear to me that, since 2001, Lowes has exhibited higher and more consistent sales and income growth than has Home Depot. The data doesn't seem to support a "turnaround" by Nardelli, unless his company was doing even worse before he got there. But the stock price data suggest that isn't true.

When you look at the data, Nardelli hasn't performed well for his shareholders on fundamental operating measures like sales and income growth. Is it really surprising the stock price is down, and the company's total returns have trailed both its major competitor, Lowes, and the S&P?

Subscribe to:

Comments (Atom)