skip to main |

skip to sidebar

This week, AMD moved to buy ATI Technologies, which manufactures chips for PC graphics, plus other accessories which may be integrated into chip sets.

On the plus side, the move helps AMD position itself as unique, vis a vis Intel, because the latter will not have a captive graphics chip maker. On the negative side, analysts are wondering if AMD can successfully handle its burgeoning price war with Intel, while integrating ATI and investing in both itself and its acquisition, to realize the long-term benefits of the combination.

What I find heartening about AMD's move is that the management evidently understands that it must "ride the tiger." Having made the moves to take on Intel and surpass it in growth, it now is planning to cement that lead.

Will it work? Who knows? This is where consistently superior prior performance makes a difference, and right now, AMD does not seem to be there just yet. Its stock price performance has been uneven, versus the S&P, over the past five years. Only recently has it turned upward, outperforming the index. In the last five years, only two look to have seen AMD outperform.Thus, its track record of surprising the market with results is not yet well-established.I think, fundamentally, the ATI move is probably a good one. Not that this means I think it will work. I just think that, as I understand their situation, they needed to do something like the ATI acquisition to keep the pressure on Intel, and place their bets for future positioning.It should be an exciting next few years, watching to see if AMD can decisively outgrow Intel, as well as earn consistently superior total returns while doing it.

Will it work? Who knows? This is where consistently superior prior performance makes a difference, and right now, AMD does not seem to be there just yet. Its stock price performance has been uneven, versus the S&P, over the past five years. Only recently has it turned upward, outperforming the index. In the last five years, only two look to have seen AMD outperform.Thus, its track record of surprising the market with results is not yet well-established.I think, fundamentally, the ATI move is probably a good one. Not that this means I think it will work. I just think that, as I understand their situation, they needed to do something like the ATI acquisition to keep the pressure on Intel, and place their bets for future positioning.It should be an exciting next few years, watching to see if AMD can decisively outgrow Intel, as well as earn consistently superior total returns while doing it.

Despite what you might think about marketing management in the era of the internet, we don't appear to know much more about consumer behavior now than we did prior to this new era.

The Wall Street Journal has featured several pieces this month concerning marketing on the internet. Early in the month, they published a "special" report about it. Then Lee Gomes wrote a review of the internet-focused hot seller, "The Long Tail," by Chris Anderson, this week.

What struck me most about the WSJ special report was that it was so anecdotal. The piece featured stories of various retailers' and marketers' attempts to, and experiences with, internet advertising and/or promotion. From what I gathered, the time honored marketing dictum, attributed originally, I believe, to John Wannamaker, is still true,

"I know I'm wasting half of my advertising spending, but I don't know which half."

At the end of the report, the Journal printed an interview with Proctor & Gamble chief marketing officer, James Stengel.

I have to say, he seems, from his comments, like a very bright guy. His basic instinct is pure marketing- to use his company, and its products, to get into the very fabric of helping his customers live better lives. He seems similarly at sea about the internet, as the rest of the interviewees in the report were. But at least Stengel is clear about where he's going with any internet initiatives.

On the age-old split between lifestyle marketing, and benefit-bundle marketing, Stengel comes down on the side of the latter. That is, he focuses on what products can do for the customer, and how internet search and advertising can help a customer realize those benefits.

This stands in sharp contrast to efforts, most notably by product placements, to sell merchandise based upon a lifestyle with which they are prominently associated.

Given Stengel's focus, one might think that Anderson's new book, "The Long Tail," would be all about how the internet lets every niche product become a star. And that is what the author claims.

However, as Lee Gomes, the WSJ columnist discovers, the basic premise of the book is fraudulent. Anderson coins a new term, apparently prominent on the book's dust jacket, "The 98 Percent Rule." Basically, Anderson alleges that with the arrival of the internet, niche products get respect, and sales volume. Thus, the sainted "80/20" rule is dead, and the "98 Percent Rule" takes its place.

Except that Gomes debunks this myth. It turns out that all Anderson observed was the early days of hit-driven product websites, where consumers bought, downloaded, etc, nearly all the titles offered. As more product came into the inventories of companies like Netflix, Amazon, Ecast, and iTunes.

So, even before this new best-seller is a year old, its central message is found to be the flawed the conclusion of hasty and badly-done "research."

Oh, well. Maybe next year someone will decode internet buying behavior. For now, though, the usual suspects plod on. Advertisers can't quite measure consumer behavior, marketing managers throw tons of money at online promotion, in hopes that something will stick. And the poor, dull business of actually observing and reflecting on how a product will affect a customer's life continues to get little respect.

Except at P&G, about which I will write more imminently.

Today is my father's 79th birthday. In honor of him, I would like to recount a story which is, to my way of thinking, his kind of humor. I can easily see him relating this story over dinner with our family when I was younger- much younger.

The tale begins with my athletic pursuits. I play a racquet sport. So I wear athletic supporters. Depending on how often you play, and how many you have, they last for varying amounts of time. I play a lot. Even with 6-7 supporters, the constant washing and drying eventually leaves them limp, the elastic overheated and stretched.

In the past, I would go to a local sporting goods store near my racquet club to buy more. The last time I did so, perhaps 5 years ago, they had a decent selection of styles and sizes. When I returned last month to buy several supporters, I was told they had none. Zero. Zippo.

"It's baseball season. We don't have any! Come back later and maybe we'll have some."

Okay. So I returned this week. They had one. One supporter in my size, although not the style I prefer. Upon asking them to order more, I was told,

"We only have one. We may not carry them anymore. Nobody comes in to buy them anymore."

I opined to the owner, apparently the son of the esteemed founder, that maybe he had it backwards. Maybe nobody came to buy supporters from him, because he had no inventory. His blank look told me I was wasting my time. But, for good measure, I uttered a prophetic,

"It's ok. Whatever you want. If you want to send me to Sports Authority, I'll go there."

Next, I visited my local sporting goods retailer, down the street from my home. Bob T's shop is the sort you remember from your childhood. Bob is a kindly, terrific guy. Like an old shoe. Perfect for the business of local sporting goods sales. He takes used ice skates on consignment. He provides the local high school uniforms, and various staples for children's and youth sports. I like to give him business when I can. So when a friend reminded me of Bob T's place, I went there the very next day. In search of supporters.

"No, sorry. We don't have any. Come back in a few weeks. We are backordered. Everything we have has cups."

When I remarked that I wanted to give them a chance, before going to Sports Authority, the woman at the counter smiled and simply repeated the facts of their inventory problem, how they'd be closed for a week, etc. Apparently, no worries over sending me to Sports Authority, either.

So, now, I've tried two friendly, local, family-owned sporting goods stores. Neither has an inventory of the rather basic piece of athletic clothing, a man's athletic supporter. Mind you, I live on the east coast of the US. Not Tibet, nor Nigeria, nor Croatia. I would have thought this search would be easier.

Today, I ran some errands. On my list was to visit another local shop. This one is a swim shop located about five miles from me. If Speedo makes it, they carry it. But before then, I found myself up on a local state highway, amidst the big box stores. So after concluding my business at ToysRUs, I decided to head for.......

Sports Authority!

As I was musing about driving to the swim shop, it occurred to me that there is a bit of a mystery in this story. Where are the nation's athletic supporters? Who has taken them, and why?

Surely, our nation's, nay, the world's athletic supporter manufacturer's and distributors cannot be leaving men "hanging out," or, well, you know what I mean.....

I formed a hypothesis on my short drive up Route 10 to Sports Authority. Perhaps SA has monopolized the provision of athletic supporters. If they had none, then, truly, there was a mystery. But if Sports Authority had supporters, that would suggest that vendors now found it difficult to bother with smaller retailers, when SA probably accounted for so much more volume.I entered the huge store, got directions, and walked to the display of men's athletic supporters.WOW! Mecca! The missing athletic supporters.....they were all there...at Sports Authority! All along!They had it all. They had brands I hadn't seen in years. In all sizes and styles. Styles I was told at the small shops could not be had anymore. Bike, for one. And for the most popular style, SA sells them 2-for-1, at about half the price of the off-brand Martin supporter I bought at the first local sporting goods shop.Now I see what has occurred with the entry of Sports Authority into my local market. I would guess it's similar for many other big box retailers in their respective product spaces. SA seems to have become a giant sponge for inventory of basic sporting goods. Your local sporting goods shop can't even get inventory on basic goods anymore. The manufacturers and distributors probably cannot afford to short Sports Authority, so they simply don't respond to requests from the small retailers.I think that most manufacturers and distributors direct their product and inventory flow to SA not just for the volume, but for the relative lack of volatility of their demand.Think about it. Sports Authority must be the size of about 10 local sporting goods shops. They concentrate the volume of all sorts of equipment, and by virtue of accounting for it in one store, reduce order volatility immensely. That has to be valuable for the vendors and distributors. By being so large, SA draws a huge flow of local shoppers. Their prices and assortments of basic goods are better than the local shops, so the circle becomes virtuous for SA.The result, I believe, is that distributors don't even bother filling orders for a lot of basics in the small quantities that local sporting goods shops order. Where's the benefit? The volume must be microscopic, next to that of Sports Authority. The cost of sending small lots, and handling the varying order sizes and frequency, can't be profitable, relative to handling a constant flow of product for Sports Authority.So, there you have it. Athletic supporters galore! They were always "there." Just not in the usual places I had learned to look. In only about five years, Sports Authority's one store in my area has altered the entire complexion of buying basic sports clothing. They so dominate the market that you literally cannot find an athletic supporter anywhere else within 10 miles of their store.So I don't live in Croatia after all. I just have come to the realization of what big box retailing does to even those small retailers who find niches that allow them to hang on in the face of outfits like Sports Authority. The supply of basic goods dries up for the small guys. They don't even get deliveries of products like athletic supporters anymore.Welcome to the new world of retailing.

Last week's .3% return for the S&P 500 index was the first positive weekly return in the last four. However, the total return for the week is somewhat misleading, as the index plunged roughly 1.6% over the last two days of the week.

The usual culprits were implicated: worries over current interest rates; concerns over energy prices causing economic growth to abate; some unexpectedly weak corporate earnings reports, and; continuing violence in the Mideast, leading investors to worry that energy supplies will be affected, thus affecting prices, and, again, economic growth, possibly leading to recession.

In equity market conditions like these, growth stocks typically take the first hit. Technology stocks, being focused on innovation and growth, are especially vulnerable. A Wall Street Journal article focused on this aspect of the recent market declines. However, by highlighting Dell and Microsoft, I am caused to wonder if they are truly "tech" stocks anymore. Both are large, sluggish, derivative purveyors of "technology" wrapped up in consumer-oriented boxes.

On the other hand, AMD was reportedly suffering from a price war with Intel, and saw its share price slide 16%.

Nevertheless, I think it's worth pausing to consider the long term perspective for equity markets right now.

First, as I learned on a recent CNBC report, most large-cap companies reporting earnings this season, for the 2nd quarter, are meeting or exceeding analysts' "expectations." Some of the major names cited as disappointments have already been in trouble, e.g., Dell, Yahoo and Ford.

Second, interest rates, while having risen, are still not yet high by historical standards. Money at 5-6% hardly constitutes a reason to believe the economy is shutting down.

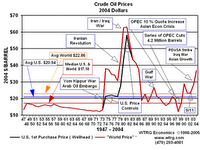

Third, real gasoline prices are still below those of several decades ago. Admittedly, crude oil is not. However, as the accompanying chart shows (click on it to view the enlarged version), it's not astronomically higher than it was, on a real basis, during the 1973-74 Arab oil embargo. At today's $75/bbl price, oil is roughly $72 in 2004 dollars, as displayed on the chart. Our economy produces much more GNP per barrel of oil today than it did in 1974. If I'm not mistaken, as much as 4 times more.

Third, real gasoline prices are still below those of several decades ago. Admittedly, crude oil is not. However, as the accompanying chart shows (click on it to view the enlarged version), it's not astronomically higher than it was, on a real basis, during the 1973-74 Arab oil embargo. At today's $75/bbl price, oil is roughly $72 in 2004 dollars, as displayed on the chart. Our economy produces much more GNP per barrel of oil today than it did in 1974. If I'm not mistaken, as much as 4 times more.

And this higher price has already triggered investments in alternative energy sources of more traditional means, as I wrote here recently. It's likely that demand and supply will continue to move about before settling at a level that fosters continued global economic growth.

I think that what we are seeing right now is the usual lemming behavior of many average investors, both institutional and retail, heading for the sidelines, and cash. They cannot see the underlying strength of the US economy, nor the relatively benign nature of current interest rates, which should forestall future inflation.

My proprietary market signaling methodology continues to register a healthy "long" position. As yet, I do not see a reason to panic, sell, or otherwise lose faith in the superior management of those companies which have shown track records of consistently superior performance.

Will it work? Who knows? This is where consistently superior prior performance makes a difference, and right now, AMD does not seem to be there just yet. Its stock price performance has been uneven, versus the S&P, over the past five years. Only recently has it turned upward, outperforming the index. In the last five years, only two look to have seen AMD outperform.

Will it work? Who knows? This is where consistently superior prior performance makes a difference, and right now, AMD does not seem to be there just yet. Its stock price performance has been uneven, versus the S&P, over the past five years. Only recently has it turned upward, outperforming the index. In the last five years, only two look to have seen AMD outperform.