Today's Exxon Mobil annual shareholder's meeting is providing a forum for the venting of anger regarding recently-retired CEO Lee Raymond's $400MM farewell compensation package.

My overall conclusion, based upon Exxon's failure to demonstrate consistently superior return performance over the period of Raymond's tenure as CEO, either as a high-growth, or low-growth company, is that he is being overpaid with this retirement package. As I've stated in several prior posts, I would simply sell the stock, if this really bothered me. In my case, though, I've already made an even stronger statement, by never buying Exxon stock in the first place.

Those who believe in "shareholder democracy," and that their withheld votes will change anything (as some state treasurer is reportedly doing today), are living in dreamland. Unless they can get some private equity firm to join them in controlling Exxon by way of a buyout, I don't think they are going to change the company all that much in the near future, from the outside. Perhaps their energy would be better spent finding other suitable companies in which to invest their capital, and depart the community of Exxon shareholders with their recent gains intact?

Or, they could heed my prior post regarding corporate governance reform, and attempt to change Exxon's board of directors, placing only those persons who hold millions of dollars of the stock bought with their own money in a position to oversee the CEO.

On the occasion of today's Exxon meeting, and the furor surrounding Raymond's payout, I did a little research on Exxon's performance, and the environment in which it has operated, going back some 25 years.

When I began working at AT&T in 1979, Exxon was still wrestling with its foray into telecommunications. The thinking back then was that oil was a business with limited future growth potential, so the firm should diversify into more promising businesses. I don't recall how many hundreds of millions of dollars Exxon poured into Exxon Enterprises, but suffice to say, the entire effort was shuttered within a decade. Even the alternative energy unit.

To say then, that Exxon has simply benefited from higher oil prices over the past 25 years is to misunderstand the number of business options available to the firm since the early 1980s, none of which they pursued, after the disastrous "diversification" program of the 1970s.

Rather, under Clifton Garvin, and then, Larry Rawl, the firm pared expenses, refocused on petroleum, and managed to survive in a world of $15/bbl oil. In fact, in articles I read this morning from that era, the firm was touted as very well managed simply for maintaining its income stream in the face of a very dismal market outlook for the forseeable future.

Following Rawl's departure, Lee Raymond took the helm, and merged with Mobil. Since then, the company has operated according to Raymond's signature style of tight expense management and cautious investment in refining and exploration.

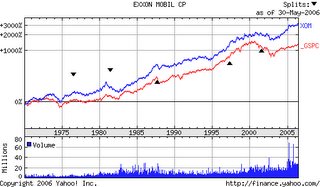

However, looking at the Yahoo-sourced chart of Exxon's share price since 1970 shown above, you can see that most of the gains in the company's stock, versus the S&P500, are in brief bursts. Of course, there's a dividend payout that would increase the implied total return for Exxon. But assuming that's been relatively steady, the chart looks more like two ships tacking with each other in a race, than it does like some consistently outperforming company pulling ahead of the S&P over many years. The gap between the "ships" slowly narrows and widens over the years, but neither ever pulls decisively away from the other for very long.

I'm not disputing that Exxon has outperformed the index over a 35 year period. It has even clearly risen by much more than the index since 2000. However, it's not so much a consistent recent total return superiority as it is a few years of high returns.

From this perspective, nobody who has been CEO of Exxon since 1970 deserves a $400MM payout for a consistently superior job well done.

And, more to the point, would Lee Raymond have left early, or declined the CEO position, if he knew he would only receive, say, $50MM upon retirement?

Doubtful. It's not about the money for people who hold these positions. They'd do the job for far less, just to have that kind of power over an asset base of that size.

To me, the real culprits here, once again, are the board members, not the CEO. Exxon's board has unwisely squandered its shareholders' money when it almost certainly could have bought similar total return performance since 1993 for far less, even from Lee Raymond.

No comments:

Post a Comment