The usual culprits were implicated: worries over current interest rates; concerns over energy prices causing economic growth to abate; some unexpectedly weak corporate earnings reports, and; continuing violence in the Mideast, leading investors to worry that energy supplies will be affected, thus affecting prices, and, again, economic growth, possibly leading to recession.

In equity market conditions like these, growth stocks typically take the first hit. Technology stocks, being focused on innovation and growth, are especially vulnerable. A Wall Street Journal article focused on this aspect of the recent market declines. However, by highlighting Dell and Microsoft, I am caused to wonder if they are truly "tech" stocks anymore. Both are large, sluggish, derivative purveyors of "technology" wrapped up in consumer-oriented boxes.

On the other hand, AMD was reportedly suffering from a price war with Intel, and saw its share price slide 16%.

Nevertheless, I think it's worth pausing to consider the long term perspective for equity markets right now.

First, as I learned on a recent CNBC report, most large-cap companies reporting earnings this season, for the 2nd quarter, are meeting or exceeding analysts' "expectations." Some of the major names cited as disappointments have already been in trouble, e.g., Dell, Yahoo and Ford.

Second, interest rates, while having risen, are still not yet high by historical standards. Money at 5-6% hardly constitutes a reason to believe the economy is shutting down.

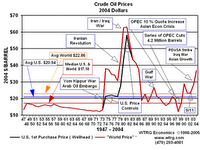

Third, real gasoline prices are still below those of several decades ago. Admittedly, crude oil is not. However, as the accompanying chart shows (click on it to view the enlarged version), it's not astronomically higher than it was, on a real basis, during the 1973-74 Arab oil embargo. At today's $75/bbl price, oil is roughly $72 in 2004 dollars, as displayed on the chart. Our economy produces much more GNP per barrel of oil today than it did in 1974. If I'm not mistaken, as much as 4 times more.

Third, real gasoline prices are still below those of several decades ago. Admittedly, crude oil is not. However, as the accompanying chart shows (click on it to view the enlarged version), it's not astronomically higher than it was, on a real basis, during the 1973-74 Arab oil embargo. At today's $75/bbl price, oil is roughly $72 in 2004 dollars, as displayed on the chart. Our economy produces much more GNP per barrel of oil today than it did in 1974. If I'm not mistaken, as much as 4 times more.And this higher price has already triggered investments in alternative energy sources of more traditional means, as I wrote here recently. It's likely that demand and supply will continue to move about before settling at a level that fosters continued global economic growth.

I think that what we are seeing right now is the usual lemming behavior of many average investors, both institutional and retail, heading for the sidelines, and cash. They cannot see the underlying strength of the US economy, nor the relatively benign nature of current interest rates, which should forestall future inflation.

My proprietary market signaling methodology continues to register a healthy "long" position. As yet, I do not see a reason to panic, sell, or otherwise lose faith in the superior management of those companies which have shown track records of consistently superior performance.

No comments:

Post a Comment