Wachovia Bank announced its intention to acquire Golden West Financial. It will be a non-hostile takeover.

The shareholders of GDW should be happy with their premium. By contrast, Wachovia's shares fell on the news.

Per my prior post on this topic, I wonder what long-term value will be created by this further concentration of financial businesses into an even larger utility.

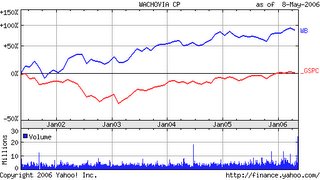

As the five year chart of Wachovia's stock price demonstrates, it has, indeed, outperformed the S&P over the time period, although most of that outperformance was in the early years of the period. This causes me to think that Wachovia may, indeed, now begin to see its total return performance wind down to that of the other three large financial utilities about which I wrote recently: Chase, Citigroup and BofA.

One has to wonder what, other than money, Wachovia brings to the Golden West operation? Decentralized control of the new entity seems almost too much to ask, for such a large acquisition. Of course, centralizing more control of the new subsidiary is bound to cause some disruptions in the performance which evidently so captivated Wachovia's leadership.

Either way, it looks like there's now room for some new, more nimble mortgage lenders in the West Coast market.

No comments:

Post a Comment