Yesterday, I compared the recent performances of Lowes and Home Depot, in an attempt to understand the accolades given Bob Nardelli for allegedly "turning around" the fundamentals at the latter company since his arrival in late 2000.

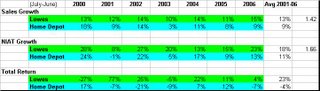

Yesterday, I compared the recent performances of Lowes and Home Depot, in an attempt to understand the accolades given Bob Nardelli for allegedly "turning around" the fundamentals at the latter company since his arrival in late 2000.In that piece, I found, using the data in the table above, from Compustat, that Nardelli does not seem to have outperformed his main competitor over the last 5 years. Home Depot's sales growth rate is not so impressive and is inconsistent as well. From my proprietary research, I would conclude that these operating characteristics alone account for Home Depot's dismal total returns since Nardelli's taking the CEO position. NIAT performance isn't much better, confirming the low regard in which investors seem to hold the company now.

It wasn't always thus. Back in July, 1999, I held Home Depot in my equity portfolio. It's performance was so strong and consistent, among that of the S&P500 field, that it was selected for inclusion, among other consistently superior companies. It subsequently returned roughly 60% from July to December, 1999.

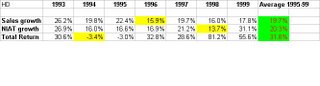

As the table at the left shows, the Home Depot of that era was a much differently performing company. Note the much higher growth rates for sales and NIAT. The green backgrounded column provides the simple averages for sales and NIAT growth, and total returns, for mid-1993 to mid-1999. The yellow highlighted cells indicate the minimum value for the measure during the period shown. Clicking on the table will bring up an enlarged view.

As the table at the left shows, the Home Depot of that era was a much differently performing company. Note the much higher growth rates for sales and NIAT. The green backgrounded column provides the simple averages for sales and NIAT growth, and total returns, for mid-1993 to mid-1999. The yellow highlighted cells indicate the minimum value for the measure during the period shown. Clicking on the table will bring up an enlarged view.Comparing these values to the ones describing Home Depot recently, one can see why the firm was much more highly valued seven years ago. It was a consistently superior, growing large-cap firm.

It's total returns were correspondingly above-average. This type of performance of a large-cap company should earn the CEO extraordinary compensation. By contrast, Nardelli's 5 year record justifies nothing even close to a compensation package suggesting he has brought success to Home Depot.

Whether Home Depot's performance was bound to decline, due to time and probabilities, is arguable. But, if it were, even more reason not to overcompensate the next CEO for failing to offset those odds. However, what is curious to me is that Home Depot hasn't underperformed on total return because investors learned to expect excellent fundamental performance from the firm. Rather, its fundamental performance simply fell apart. And that has nothing to do with "uncontrollable market forces." Those are the types of problems CEOs are well-paid to fix. And Nardelli has not done that during his five years leading Home Depot.

1 comment:

He obviously is only into Home Depot for the money. He has no concept of what this business is really about. Customers are leaving THD and going to it's competitors because of the help or the lack of, along with the experience level of its' associates there.I used to shop Depot on a regular basis till about 2-3 years ago. No I go elsewhere because the people now at the Depot don't seem to care. I walked into the Brentwood store, I started in the garden area, and was able to walk to the millworks area before being acknowledged by an associate, and mind you there were plenty of associates on duty when I went there. They just walked on by.

Post a Comment