I'm not a balance sheet type of guy. Most of my analysis focuses on changes in income statement items, because I believe that the ultimate goal of CEOs, and investors, should be to earn consistently superior total returns with a company's assets. My proprietary research has found that changes in income statement items are most associated with changes in total returns, especially for growth companies.

However, I am aware that GE is among the largest, if not the largest, US public company by assets. It's certainly among the top 5, I would think.

In the company's recent annual report, which you may find on the GE website, Immelt, the CEO, claims, in a bold headline, that GE is "sized to perform for investors."

Really?

Here's a table of GE's recent "performance," in terms of growth in revenues and NIAT, market value, and total return for its investors (click on the table to see an enlarged version) from July of 2000 to July of 2006. The S&P500 Index annual return is included for comparison purposes. The blue column provides the average for the last seven years, while the tan column and cells display the minimum values over the seven year period.

Here's a table of GE's recent "performance," in terms of growth in revenues and NIAT, market value, and total return for its investors (click on the table to see an enlarged version) from July of 2000 to July of 2006. The S&P500 Index annual return is included for comparison purposes. The blue column provides the average for the last seven years, while the tan column and cells display the minimum values over the seven year period.As I look at this table, what jumps out at me is how mediocre GE has been. Its sales growth is an S&P ballpark average of roughly 6%. NIAT growth is a bit higher, so that means management is squeezing profits out of the slow-growing company, to get the 10% average on that measure. Average total return is an anemic 3.7% over the period. Better than the 1.2% average for the S&P, but with 3 negative years, including one in which return plunged almost 40%. Immelt is responsible for the period 2002-2006, when the average total return of the company was -2.8%, compared to the S&P's +3.2%.

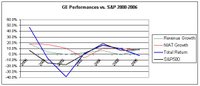

Here is some of the same data, in chart form (again, clicking on the chart will bring up a larger version). On balance, GE has been, for the last 7 12-month periods, an inconsistently mediocre company. The slim margin of 2.5 percentage points of outperformance over the S&P is hardly worth the risk entailed by holding the company's stock for 7 years.

Here is some of the same data, in chart form (again, clicking on the chart will bring up a larger version). On balance, GE has been, for the last 7 12-month periods, an inconsistently mediocre company. The slim margin of 2.5 percentage points of outperformance over the S&P is hardly worth the risk entailed by holding the company's stock for 7 years.So, I ask again, for "what" exactly is GE "sized to perform for investors?" Certainly not returns.

No, I've come to the conclusion that GE is sized to provide highly compensated jobs for its senior managers, particularly Jeff Immelt.

Consider this. The company now has a market value of roughly $350B. It is organized into six major business units, no one of which currently has revenues of less than $15B. Here is a table from the GE annual report providing the details (once again, click on it to enlarge). This is one huge company. And it's not all that lopsided. The largest major component, Infrastructure, has $41B in revenues, or less than 3x that of the smallest unit, NBC Universal.

Consider this. The company now has a market value of roughly $350B. It is organized into six major business units, no one of which currently has revenues of less than $15B. Here is a table from the GE annual report providing the details (once again, click on it to enlarge). This is one huge company. And it's not all that lopsided. The largest major component, Infrastructure, has $41B in revenues, or less than 3x that of the smallest unit, NBC Universal.In this era of private equity buyouts and plentiful capital, why do these business units need to be under one corporate umbrella? It's hard to believe finance and adminstration functions require such scale. In fact, each unit probably has its own basic administration functions. And if the vaunted GE research labs are really key to every unit, they could jointly fund those labs and buy desired research results, patents, and inventions.

With such a mediocre track record for the better part of a decade, while compensating Immelt so richly, as I have discussed here, what possible defense is there for keeping this behemoth intact anymore?

The days of Thomas Edison's end-to-end electrical system supply enterprise are long, long gone. I contend that each of these business units, and perhaps even more, at lower levels, could be spun off independently, to GE's investors' benefit. It's hard to believe that this collection of such different businesses can realistically derive value from being in a common corporate domicile, let alone generate excess returns because of that common home to pay for the lush compensation of the various senior executives.

I can't see any downside to breaking up GE into its component businesses. Does anyone else?

No comments:

Post a Comment