The recent USAirways bid for Delta has sparked quite a bit of business media comment. Holman Jenkins wrote a good piece on Wednesday in the Wall Street Journal.

Essentially, he notes that US Airways CEO Doug Parker's proposed acquisition "might have been inspired by the old joke about two hunters trying to outrun a bear."

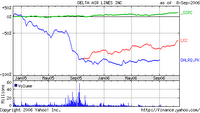

Just so. As the Yahoo-sourced chart of US Airways', Delta's, and the S&P500's prices for the past two years (click on chart to see an enlarged version) illustrates, It is not a merger of two strong competitors.

Delta is in bankruptcy. US Airways is somewhat difficult to track prior to a year or so ago, when, thru a merger, the price trail was more or less obliterated, as America West took US Airways' name.

However, in the past year, US Airways has clearly outperformed the S&P, while Delta languishes. Contrary to the pundits who declare that most desirable airline mergers combine non-overlapping airlines, this one promises to help remove excess capacity in similar markets. Which, of course, should firm up pricing for US Airways. Additionally, as Jenkins noted in his piece, it leaves the merged airline with slots at Kennedy and O'Hare, where new entrants have difficulty obtaining gates.

So much for the value of the merger.

However, the larger issue, to me, is competition in an industry in which so much of the business model is either shared and in common with competitors, or easily obtainable, thus lowering barriers to entry.

Specifically, all airlines must, of necessity, use the same airports. Thus, they rely on shared airport management, the FAA, baggage systems, and, in some cases, reservation systems. Anyone with money can start and airline and lease planes from the usual suspects, including GE Capital.

Thus, little is left in the control of an airline's management to actually make a sustained difference to customers, for which the latter will pay revenues that drive a consistently superior total return in the market.

I've pondered this sector for some time, as Southwest Air is, to my knowledge, the only airline ever to be selected, using my quantitative, disciplined process, for my equity portfolio.

This proposed merger does not alter my view. I think in the current market structure, a focus on building a regional strength, with low costs due to common equipment, for maximum use of crews and low training and maintenance costs, are key. The hub and spoke system probably means there are regional physical barriers to airline growth, if the company wishes to enjoy any significant period of consistently superior total returns.

Moving beyond that typically sees an airline struggle with expensive logistical issues and traffic feeder/load factor issues.

It could well be, thanks to the structure of this sector, that its players are simply unlikely to earn many years of consistently superior total returns.

No comments:

Post a Comment