It looks like Dick Parsons is presiding over the erosion of a core business, and still doesn't know what is driving TW's stock price. There's a lot of hubbub right now over TW's recent stock price rise, as if it is "turning around." For more on this topic, see my recent post, here. Three months, however, do not a turnaround make. Not when one of the company's main businesses is hemorrhaging revenues, due to inept strategic management and planning.

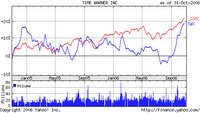

As the Yahoo-sourced chart nearby shows (click on the chart to enlarge), over the past 3 months, TW has risen some 20%, while the S&P is up less than 10%. However, looking at 2 year (below) and 5 year (unable to get Blogger to paste it) charts, TW and the index are both up about 20% for the first period, but TW is down slightly less than 50% for the second period, while the S&P is up between 20% and 30%.

As the Yahoo-sourced chart nearby shows (click on the chart to enlarge), over the past 3 months, TW has risen some 20%, while the S&P is up less than 10%. However, looking at 2 year (below) and 5 year (unable to get Blogger to paste it) charts, TW and the index are both up about 20% for the first period, but TW is down slightly less than 50% for the second period, while the S&P is up between 20% and 30%.

The WSJ piece provides some insights into what has gone wrong with the magazine group under Moore's stewardship. Although the article quotes Moore as saying,

"Everyone is so worried that we're late coming to the party....this party is not over...The party just started. We've gotten to the real tipping point. The one thing I've learned this year is that there is a real business here."

Now, that is sad. Only this year has Moore realized what Google, Yahoo and other online sites have known for some time- that people now receive their important news online. Breaking news is online, and immediate followup coverage of breaking news can be in the form of a daily newspaper. But the weekly plain vanilla "news" magazine is in trouble, i.e., Time. That Sports Illustrated and CNNMoney are the major recipients of Time, Inc.'s online attentions only highlight that they do not cover typical, generic news topics.

Moore has had the top job at Time, Inc. for four years now, but, before that, was credited, in her 28 years with the company, with a knack for creating new titles, such as InStyle and Real Simple.

However, one only needs to step back and view the overall media landscape to see that Moore is probably as wrong a fit for her job as Parsons is for his. The company overall, and its magazine division particularly, suffer from being an old media giant, with its assets and brand values rooted in print distribution, while most of the people who value that information have already headed for the internet to find such content. That Moore thinks the game is just starting demonstrates how seriously she misunderstands the manner in which media consumption habits are developed, and brands are built. Meanwhile, her boss, Parsons, was characterized on CNBC this morning as being a "diplomat," selected to replace Gerald Levin at a time of tremendous organizational crisis at the firm, in the wake of the AOL merger disaster. Now, Parsons' skills as a lawyer and mediator seem badly deficient for the rather basic task of operational management of the current business portfolio, and strategic development of it for the future.

Again, taking that large step backward to view overall media, you can see that, with internet-based information distribution, the old boundaries between print and video, instant, daily, weekly, and monthly, are gone. Content distribution, consumer consumption, and, with them, advertising, have all been migrating to the web in increasing volumes. In this environment, what tangible value propositions do print magazines like Time and People now offer?

The Journal article mentions that, among the alternatives being discussed, is to make Time more like The Economist. I subscribe to the latter, and I frankly can't ever see the former mounting a serious challenge. Part of what makes The Economist what it is, is the international outlook from its British base. I doubt that Time will never be able to match that, let alone attract the talent to deepen its analytical capabilities.

Truth is, TW is holding media assets that are dwindling in value, as the plunging ad revenues indicate. Thus, the layoffs and cost-cutting at Time, Inc., parallel similar actions at the nation's struggling newspapers. As further evidence of both the magnitude of the problem, and the ineptitude and lack of confidence of the division's management, it has retained McKinsey to study its options for solutions.

All of which causes me to ignore the recent bounce in TW's stock price, and take, as usual, my longer-term view. I think this company is only gaining value for short-term reasons; either a divestiture of AOL, or radical one-time cost cuts which may fall to the bottom line. But on an ongoing basis, I believe the company's brands are, for the most part, damaged goods. The management team isn't up to fixing them, or even competently developing a strategy to maximize the value to shareholders of what's left. That's why they called in McKinsey.

In my opinion, TimeWarner will continue to deliver, over the long term, inferior total returns to its shareholders, while it is still around in its current incarnation.

No comments:

Post a Comment